This post may contain affiliate links from which I may earn a commission without any cost to you. Read our policy for details.

Wondering how to invest 50k? Our guide will show you the best way to grow your money and reach your investment goals.

You’re in a great position if you have $50,000 to invest. You can start with a solid foundation and then build on it over time.

When considering how to invest your money best, you must first fix your goals.

It can be anything, like do you want to save for early retirement? Save for a down payment on a home? or build up a fund for your dream business?

Once you know your goals, you can look at different investment options. There are many different ways to invest, so it’s essential to find the best fit for you.

Best Ways to Invest Your 50K Dollars

Here are a few options to consider if you’re looking for the best way to invest $50,000.

1. Invest with Robo Advisors

Many people station cash in low-yield savings accounts because they’re risk-averse and don’t want to invest in the stock market.

It takes a lot of time for such people to consider investing in stock markets, which is normal.

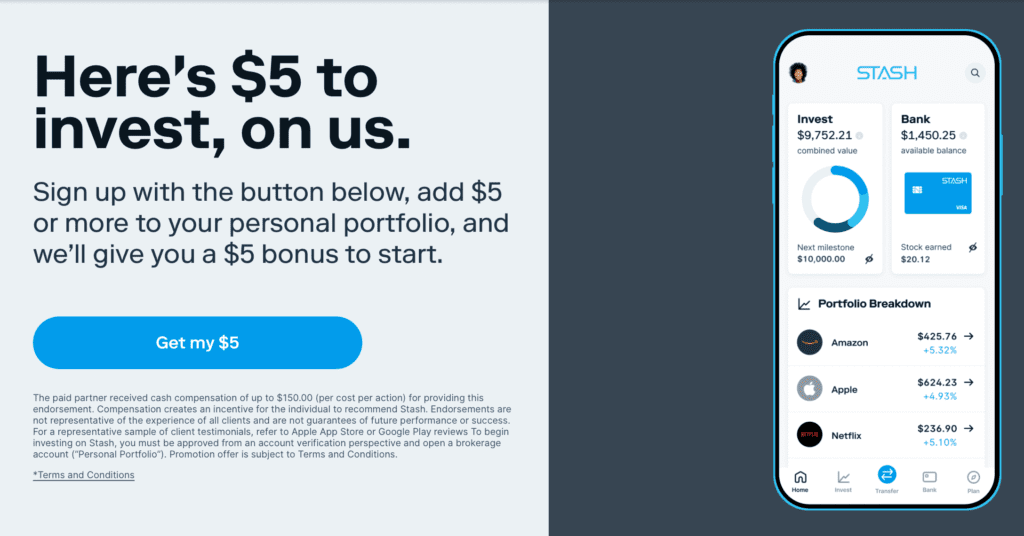

If you are ready to invest, you may wonder how to invest 50k. Robo investors can be a good option for those who want to invest without putting in a lot of time and effort.

Robo investors offer automated investing services that can help you grow your wealth over time without having to monitor your investments constantly.

With a Robo investor, you can set your investment goals, and the Robo investor will work to meet those goals.

If you’re looking for a hands-off way to invest your money, investing with a Robo investor may be right.

The best of these investment platforms are Acorns and Stash.

2. Invest in Stocks

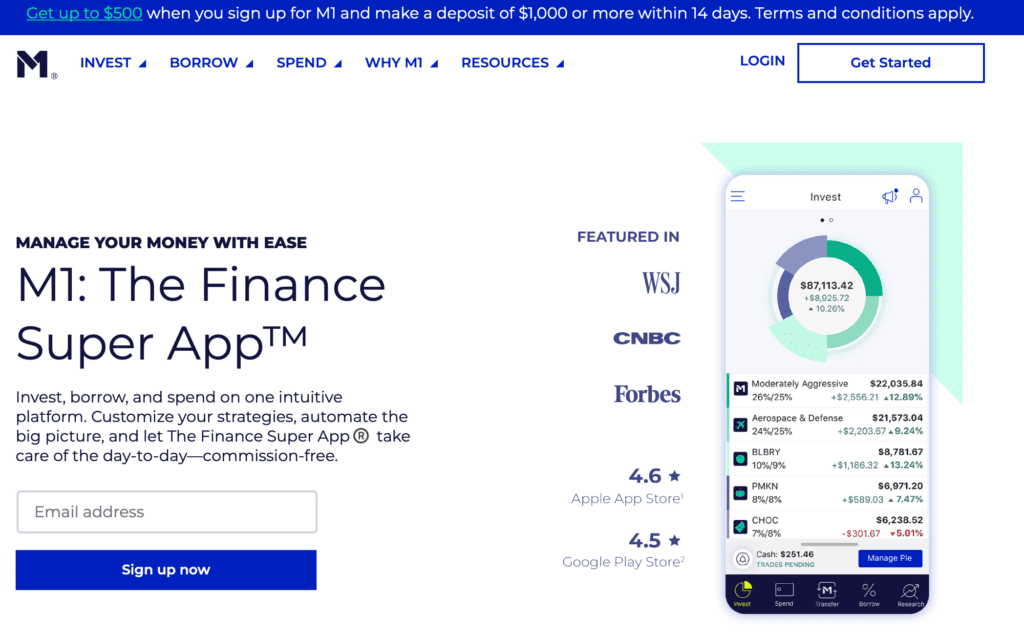

Stocks are always risky, but if done correctly, they can offer a higher return on investment than more traditional options like bonds or CDs.

When investing in stocks, it’s important to remember that you’re buying a piece of a company; therefore, your investment will fluctuate with the company’s success.

For example, if you purchase 100 shares of stock in a company that’s doing well, the value of your shares will likely increase. However, if the company hits a rough patch, the value of your shares will decrease.

You can increase your chance of success if you can do a fundamental analysis of companies and choose stocks based on your analysis.

One of the best platforms to invest in stocks is M1finance.

3. Real Estate

One of the best ways to invest 50k is to purchase a rental property. Rental properties can offer a steadier stream of income than stocks, and they also have the potential to appreciate over time.

When investing in rental property, it’s important to research the market carefully and ensure you’re purchasing a property that will be in demand by renters.

Another way to invest in real estate is through Fundrise. Fundrise is a real estate investment platform that allows you to invest in a diversified portfolio of properties without having to put down a large sum of money upfront.

Related: Best passive income apps!

4. Invest in Mutual Funds

Many people with 50k or more to invest are unsure how to get started. One option is to invest in mutual funds.

Mutual funds are investment vehicles that pool money from many investors and invest it in various securities, such as stocks, bonds, and other assets.

Investing in mutual funds includes professional management, diversification, and affordability.

For example, if you have 50k to invest, you could purchase shares in a mutual fund that invests in large-cap stocks. This would expose you to a diversified portfolio of companies without purchasing individual shares.

Another option would be to invest in a bond mutual fund. This would give you income and the potential for capital appreciation over time with more safety.

Before investing in any mutual fund, it is essential to research the fees and expenses associated with the fund. These can have a significant impact on your overall return.

With careful planning and due diligence, investing in mutual funds can be an intelligent way to reach your financial goals.

5. Invest in Index Funds

Many people choose to invest in index funds because they are a low-cost way to gain exposure to a broad range of assets.

Index funds typically have expense ratios of 0.2% or less, much lower than the fees charged by actively managed funds.

When investing in index funds, it’s important to consider how you will allocate your assets. For example, if you are investing $50,000, you might choose to invest $25,000 in a domestic stock market index fund and $25,000 in an international stock market index fund.

Alternatively, you could invest some amount in a bond index fund. Once you have decided how to allocate your assets, you can begin researching index funds that fit your investment objectives.

When selecting an index fund, it’s essential to consider factors such as its expense ratio, performance history, and holdings.

By carefully considering these factors, you can select an index fund to help you meet your investment goals.

6. Invest in High Worth Artwork

If you’re looking for how to invest 50k, there’s no shortage of options. There are myriad ways to invest your money, from stocks and bonds to real estate and cryptocurrency.

However, if you’re looking for a high-worth investment that has the potential to appreciate, you may want to consider investing in artwork.

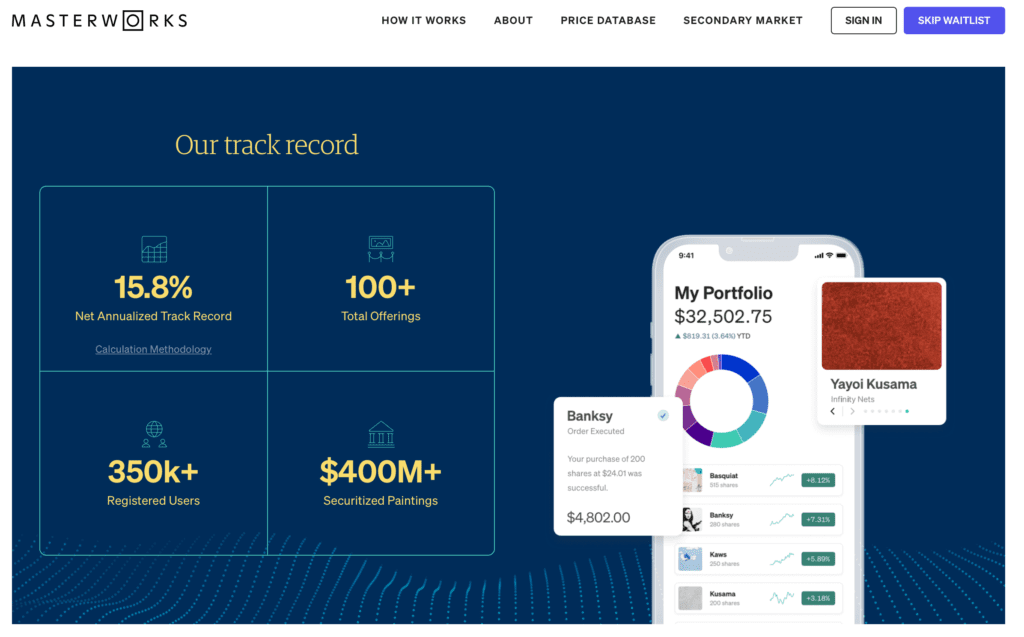

Thanks to online platforms like Masterworks, it’s easier than ever to invest in paintings and sculptures by some of the world’s most famous artists.

Whether you’re a seasoned investor or just starting, investing in the artwork is a smart way to grow your portfolio.

7. Invest in Bonds

If you’re looking to invest 50k in bonds, you’ll need to decide what type of bond you’re interested in.

There are two primary types of bonds: corporate bonds and government bonds. Private companies issue corporate bonds, while government entities issue government bonds.

Each type of bond has its risks and rewards, so it’s essential to do your research before investing.

Once you’ve decided what type of bond you want to invest in, the next step is determining how much risk you’re willing to take. Bonds are typically classified as either high-risk or low-risk investments.

High-risk bonds tend to offer higher returns, but they also come with a greater risk of default. Low-risk bonds offer lower returns but are less likely to default. Again, it’s important to do your research and choose an investment that fits your risk tolerance.

Finally, you’ll need to decide how long you plan to hold onto your bonds. Bond prices fluctuate, so choosing a timeframe that works for you is crucial.

8. Invest in a CD or Savings Account

When it comes to investing, there are many options available. One option for those with significant money to invest is to put the money into a CD or savings account.

Though interest rates are very low, both options offer a safe way to grow your money and can be a good choice for those new to investing.

With a CD, you will earn interest on your deposit, and the money will be accessible after a set period.

With a savings account, you will earn interest on your deposit, and the funds will be accessible anytime.

Both options offer grown opportunities, and choosing between them will depend on your individual needs and goals. Regardless of your choice, investing in a CD or savings account can be a safe way to grow your money over time.

9. Invest in Cryptocurrency

Before investing in cryptocurrency, do your research and understand the risks involved. Cryptocurrency is a volatile market, and prices can fluctuate rapidly.

It would help if you also clearly understood how this technology works before investing any money.

Then choose a reputable exchange such as Binance that offers a variety of coins to choose from.

There are a lot of scams out there, so it’s essential to be careful when selecting an exchange.

It’s generally recommended to start with small investments and slowly increase your position over time. Following these tips can maximize your chances of success in the cryptocurrency market.

10. Invest in a Roth IRA

A Roth IRA is one of the best ways to save for retirement. Not only does it offer tax-free growth, but it also allows you to withdraw your money tax-free in retirement.

If you’re looking for how to invest 50k, a Roth IRA is a great option.

Choose a Roth IRA provider after considering different options, so do your research and compare fees before making a decision.

Once you’ve chosen a provider, you’ll need to open and fund an account. You can do this by making one-time or regular contributions over time.

After funding the account, you’ll need to choose how to invest your money. You can do this yourself or work with a financial advisor who can help you create an investment plan that fits your goals and risk tolerance.

Regardless of how you choose to invest, the important thing is that you start investing early to reach your retirement goals.

11. Invest Using P2P Lending

One option for investing your money is to invest in peer-to-peer (P2P) lending. This investment involves lending money to individuals or businesses through online platforms.

P2P lending platforms typically have algorithms that assess the creditworthiness of borrowers and then match them with suitable investors.

Returns on P2P investments can vary depending on the platform and the specific loan, but they typically range from 5-12%. Given that, investing 50k in P2P lending could generate annual returns of up to 6k.

Of course, as with any investment, there are risks involved with P2P lending. The most significant risk is the default when a borrower cannot repay their loan.

However, most P2P platforms have measures to protect investors from this risk, such as reserve funds that cover losses in the event of a default.

Also, spreading your investments across multiple loans can help mitigate the risk of loss.

Overall, P2P lending can be a great way to earn higher returns on your investment, but it’s important to research and understand the risks involved before you commit any money.

12. Invest in Yourself

Investing in yourself is the best investment you will ever make. This can mean taking courses or getting professional training to help you advance in your career.

It may seem daunting, but there are many ways to invest in yourself. You can start by taking care of your physical health. Eating healthy foods and exercising regularly will help you maintain energy and focus.

You can also invest in your mental health by learning how to manage stress and anxiety.

This will help you stay sharp and focused when challenging situations arise. Finally, you can invest in your relationships by spending time with loved ones and cultivating solid friendships.

These investments will pay off in all areas of your life, making you happier, healthier, and more successful. So if you’re wondering how to invest 50k, look no further than yourself to invest at least a part of it for yourself.

13. Invest in a Business-owning

Another great way to invest your money is to invest in a business. This can be done by starting your own business or investing in an existing business.

When you invest in a business, you are putting your money into something that has the potential to grow and generate a lot of income.

Before starting a business, have a clear idea of what you want your business to be.

Are you going to sell a product or a service? What industry are you going in? Who is your target market? Once you have a good understanding of your business, you need to create a business plan.

This will help you map your goals and achieve them.

Then put together a team of talented individuals who can help you turn your vision into a reality. Investing in a well-thought-out business plan increases your chances of success tremendously.

14. Pay Your Debt

Many people find themselves in a situation where they have some extra money to invest, but they’re not sure how to best use it. One option is to pay down debts.

This can be a good strategy, especially if the interest rate on the debt is high.

By paying off the debt, you’ll save money on interest payments and will be able to use the extra money to improve your financial situation in many ways.

Whether investing money in stocks makes sense or paying off debt makes sense, you need to make a wise decision based on returns.

15. Invest in Emergency Fund

You may wonder how to invest it best if you’re lucky enough to have an extra $50,000. One option is to use the money to create an emergency fund.

This can be a smart move, especially if you don’t currently have any savings set aside for unexpected expenses. An emergency fund can give you peace of mind knowing that you have a cushion to fall back on if something unexpected arises.

There are several ways to invest your $50,000 to create an emergency fund. One option is to open a high-yield savings account and deposit the money into it.

This account will likely earn interest on your balance, which can help grow your savings.

Another option is to invest the money in a short-term bond fund. This can provide stability and modest returns while allowing access to your money if you need it in a pinch.

These are just a few of the many options available to you when you’re looking to invest $50,000. You can also talk to a financial advisor to learn the best way to invest your money based on your specific situation.

Tips to Invest 50,000 Dollars

Determine What is Your Risk Tolerance

You first need to assess your risk tolerance, which will help you narrow your investment options and find the best way to invest your money.

Your risk tolerance is how much risk you’re willing to take to achieve your goals. If you’re eager to take on more risk, you can potentially earn higher returns. But there’s also a greater chance you could lose money.

If you’re not comfortable taking on many risks, that’s OK. There are still plenty of investment options available to you, and it’s just important to find the right balance for you.

Some people are willing to take on more risks to achieve their goals. Others are more conservative and don’t want to risk losing their investment.

Knowing your risk tolerance is an essential first step in finding the best investment method.

Consider Your Time Horizon

Your time horizon is the time you have to reach your goals, and this can play a significant role in deciding how to invest your money best.

If you have a long time horizon, you can afford to take on more risk. This is because you have time to ride out any market ups and downs.

Over the long term, the stock market has historically gone up. So if you’re investing for retirement, for example, you can afford to take on more risk.

But if you have a shorter time horizon, you may need to be more conservative with your investments. This is because you don’t have as much time to compensate for losses.

Think about when you need the money and how much risk you’re comfortable taking. This will help you find the best way to invest your money.

Diversify Your Investments

Once you know your goals and risk tolerance, you must make diversified investments. This means investing in different assets, such as stocks, bonds, and real estate.

Diversifying your investments helps to protect you from market fluctuations.

When one type of investment is doing poorly, another may be doing well, and this can help balance out your portfolio and reduce your overall risk.

Diversifying your investments is also important to help reduce your overall risk. You can weather any market conditions with a well-rounded portfolio and still reach your financial goals.

Final Thoughts on How to Invest 50K

There’s no one perfect way to invest $50,000. But by considering your goals, risk tolerance, and time horizon, you can find the best way to invest your money.

It is a big decision and one that should not be taken lightly.

As we see above, there are many different options, and it can be challenging to know which is right for you. However, you can make the best decision for your needs by researching and talking to a financial advisor and doing your research.

With so much money on the line, it is important to ensure you are comfortable with the investment and understand the risks involved.

Sumeet is a Certified Financial Education Instructor℠ (CFEI®) and the founder of Dollarsrise. He has been writing about earning extra cash online from his personal experiences for the last four years and his work has been quoted in top finance websites like Yahoo! Finance, GOBankingRates, CNBC, and more. Follow this website to learn easy and real-life hacks to raise your pile of dollars.