This post may contain affiliate links from which I may earn a commission without any cost to you. Read our policy for details.

It’s no secret that the more money you have, the easier life becomes. But what if you’re starting from scratch? How can you turn 10k into 100k?

The good news is that there are several ways to turn your money around. It might be investing, flipping a business, or combining multiple side hustle ideas.

But you need to figure out which ones are appropriate for you that fit into your goals.

You can turn $10,000 into $100,000 if you’re willing to put in the time and commit to the process.

Before you invest the entire $10,000 in the stock market with the newest hot stock, do your homework and keep your portfolio diversified so you don’t lose your money.

Continue reading to learn more about different investment choices and possibilities so you can choose the most refined approach to convert 10k into 100k and get to work.

How to Turn $10K into $100K

There are a few things you can do to make your money grow. Keep in mind that the chance of loss is also higher if you are looking after high-yielding ways.

Safer investments like FDs are low-yielding, but riskier investments like stocks or P2P lending can give you returns of 10-12% annually.

Here are a few options to grow your money:

1. Invest in cryptocurrency

So, you’ve got $10,000 in your pocket. What should you do with it? While there are many options, cryptocurrency is one of the smartest investments you can make.

Here’s how you can turn your $10,000 into $100,000 by investing in cryptocurrency.

To start, you’ll need to choose a reputable exchange like Gemini to buy and trade cryptocurrency.

Once you’ve done that, you can start buying Bitcoin, Ethereum, Litecoin, or any other number of coins or tokens. The key is to invest early and often and to hold onto your investments for the long term.

Of course, cryptocurrency is a volatile market, so there is risk involved. However, you could see tremendous returns if you’re smart about your investments.

With some luck, you could turn your $10,000 into $100,000 in no time.

2. Start a business

Have you ever wanted to be your own boss? If you have an entrepreneurial spirit and business acumen, then starting your own business may be the right move.

Of course, it takes more than just a great idea to start a successful business. You’ll need to be able to articulate your vision, build a strong team, and create a solid plan for how to turn your idea into a reality.

But if you’re willing to put in the hard work, starting a business can be an enriching experience.

There’s no one-size-fits-all formula for starting a business, but there are some basic steps that all entrepreneurs should take.

Research your industry and develop a clear understanding of the market.

Then, you’ll need to develop a unique selling proposition and create a powerful branding strategy.

Once you have a solid foundation in place, you can start working on building your customer base and generating sales.

Of course, it takes more than hard work to succeed in business. You’ll also need to be strategic, resourceful, and adaptable.

But if you have what it takes, starting your own business can be an incredibly rewarding experience.

3. Invest in Real Estate

If you’re looking for a more hands-off approach to investing, you may want to consider investing in real estate.

Real estate investing can be a great way to generate passive income and build long-term wealth.

There are several ways to invest in real estate, but one of the most popular methods is buying rental properties.

Rental properties can provide you with a steady income stream and can also appreciate value over time.

Another popular method of real estate investing is to “flip” properties. This flipping involves buying a property, making improvements, and selling it for a profit.

Flipping can be a great way to make a quick return on your investment, but it does require a bit more work than investing in rental properties.

You can give your 10k as a down payment, take loans to buy properties, and flip them for profit. If you do it correctly, you can make huge profits from each project.

Invest with Fundrise

If you want automated investing in real estate without any effort, one of the best ways to do this is to invest in a Fundrise account.

A Fundrise account is a great way to grow your money while taking advantage of the company’s knowledge and expertise in the real estate industry.

Fundrise will help you diversify your portfolio and invest in various properties, minimizing your risk and maximizing your return.

Plus, with a Fundrise account, you’ll enjoy the benefits of automated investing, which means you can sit back and watch your money grow without having to do any work.

So if you’re looking for a hands-off way to invest in real estate, a Fundrise account may be the perfect solution.

4. Put Your Money in a High-Yield Savings Account

If you’re looking for a safe and conservative way to grow your money, you may want to consider putting your money in a high-yield savings account.

Savings accounts are FDIC insured, which means your money is protected against loss.

Plus, savings accounts offer a relatively low-risk way to grow your money.

While the interest rates on savings accounts are generally lower than those on other types of investments, the interest can add up over time, and you won’t have to worry about losing your principal investment.

So if you’re looking for a safe and easy way to grow your money, a high-yield savings account may be the perfect solution.

You can keep your money in high-yielding accounts like Aspiration, which pay 3-5% annual returns on your capital up to $10,000.

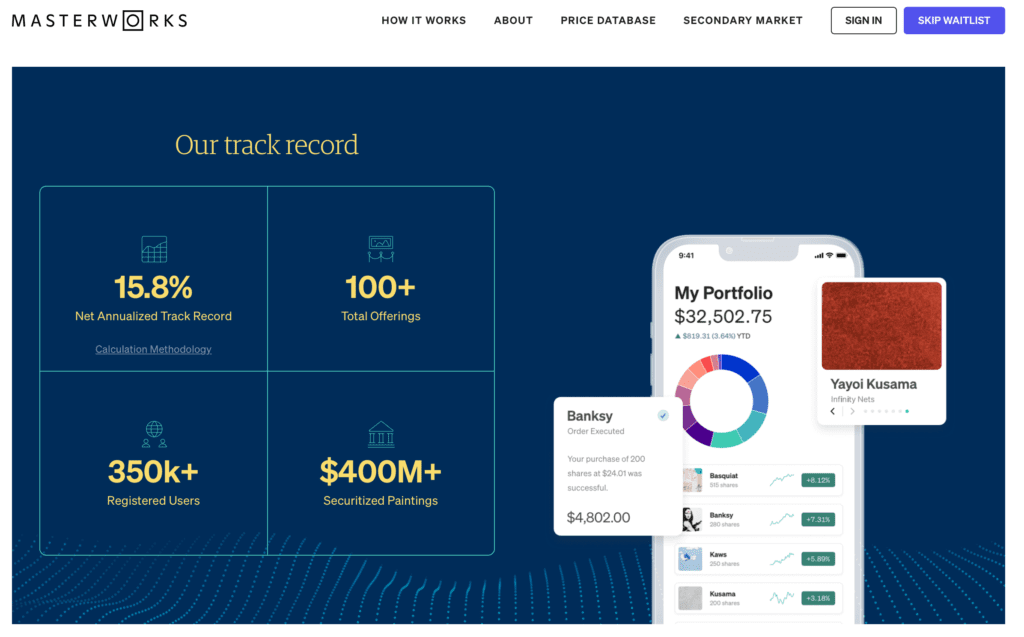

5. Invest Your Money in Art with Masterworks

If you’re looking for a unique way to invest your money, you may want to consider investing in art with Masterworks.

Masterworks is a company that allows investors to purchase shares of iconic paintings.

This is a great way to invest in art because it offers the potential for both appreciation and income.

Plus, with Masterworks, you can start investing with very little money.

So if you’re looking for a unique way to grow your money, investing in art with Masterworks may be the perfect solution.

6. Invest in Stocks

Investing in stocks is one of the most popular ways to grow your money.

When you invest in stocks, you buy a piece of a company. As the company grows and becomes more profitable, the value of your shares will also increase.

Of course, investing in stocks comes with some risk. The value of your shares can go down and up, so you could lose money.

But if you’re comfortable with the risk, investing in stocks can be a great way to grow your money.

Plus, there are several different ways to invest in stocks, so you can find an approach that fits your personality and risk tolerance.

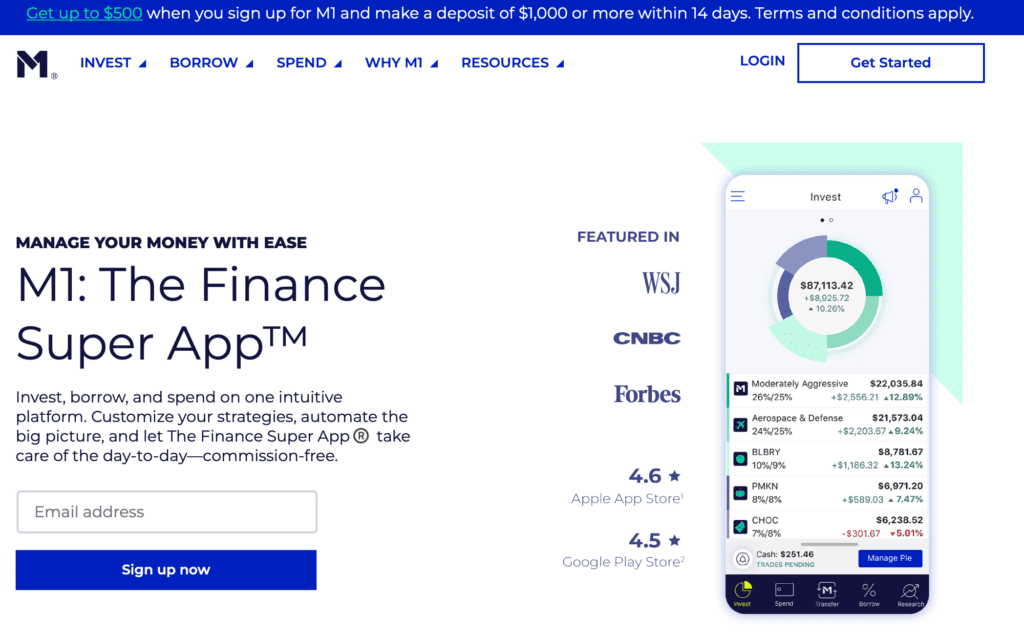

7. Play the Stock Market

If you’re looking for a more hands-on way to grow your money, you may want to consider playing the stock market.

The stock market is a great way to learn about investing while potentially making money. There are platforms like M1finance that have minimal to zero fees.

Of course, the stock market can be a bit volatile, so you could lose money as well as make money.

But if you’re comfortable with the risk, playing the stock market can be a great way to grow your money.

8. Invest in Mutual Funds

Investing in mutual funds is another excellent way to grow your money.

Mutual funds are a type of investment that allows you to pool your money with other investors.

This can help you diversify your portfolio and minimize your risk.

Plus, you can start investing with very little money with most mutual fund companies.

So if you’re looking for a safe and easy way to grow your money, investing in mutual funds may be the perfect solution.

9. Invest in Index Funds

Investing in index funds is one of the smartest things you can do with your money. Over time, index funds have outperformed most other investments, including stocks, bonds, etc.

And yet, many people still don’t understand how index funds work or how to invest in them. Luckily, it’s not as difficult as it sounds.

Index funds are mutual funds that track the market index, such as the Dow Jones Industrial Average or the S&P 500.

When you invest in an index fund, you effectively invest in all the companies that make up that index. Index funds are a great way to diversify your portfolio and reduce risk.

And because they are passively managed, they also tend to have lower fees than other types of mutual funds.

Investing in index funds is an excellent option if you want to grow your money long-term. Just remember to start small and reinvest your dividends to compound your returns. With time and patience, you can turn 10k into 100k.

10. Invest in Precious Metals

Investing in precious metals is a great way to diversify your portfolio and protect your wealth. Gold, silver, and platinum are all excellent choices.

And because they are physical assets, you can always hold them in your hand as a tangible reminder of your wealth.

Of course, investing in precious metals comes with some risk, and the price of gold and silver can fluctuate quite a bit.

And if you decide to invest in platinum, you’ll need to be comfortable with the volatile market.

But if you’re willing to take on some risk, investing in precious metals is a great way to grow your money.

11. Make Money with Retail Arbitrage

Many people are looking for ways to make extra money, and retail arbitrage can be a great option.

Essentially, retail arbitrage involves finding products at a low cost and selling them for a higher price.

With some research, it is possible to find sellable products for a 100% profit.

While it may take some time to get started, the potential earnings from retail arbitrage can be significant.

For example, starting with a $10,000 investment could potentially earn $100,000 in profits within a year.

Of course, not every product will be a winner, but the key is to focus on high-demand items that are likely to sell quickly. With a bit of effort, retail arbitrage can be a great way to make money.

12. Start a Blog

Starting a blog may be the perfect solution if you’re looking for a creative way to make money.

Blogging is a great way to share your interests and passions. And if you build up a large enough audience, you can make money from your blog through advertising and affiliate marketing.

Of course, it takes time and effort to build up a successful blog. But being patient and willing to work hard can be a great way to make money.

13. Start a Youtube Channel

Youtube is one of the most popular websites in the world, with over a billion users. And if you can build up a large enough following, you can make money from your Youtube channel through advertising and sponsorships.

Of course, it takes time and effort to build up a successful Youtube channel. But being patient and willing to work hard can be a great way to make money.

14. Flip Websites

If you have web development skills, flipping websites could be a great way to make an extra $100,000. You can buy websites that are already established and earn money and sell them for a profit.

To find websites for sale, you can search on sites like Flippa and Empire Flippers. Once you find a website you’re interested in, you’ll need to negotiate a price with the seller.

If you don’t have the skills or time to build a website from scratch, you can still make money by flipping websites.

You can buy a website that needs some work and then invest time and money into fixing it. Once you’ve made the improvements, you can sell the website for a profit.

Flipping websites could be a great option if you’re looking for a more passive way to turn $10,000 into $100,000.

15. Flip Small Businesses

If you have the entrepreneurial itch, buy a small business already up and running.

Find one that’s undervalued and in a good industry with growth potential. Once you purchase it, implement systems to make it run more efficiently and effectively.

After increasing its value, sell it for a profit. You could quickly turn a $10,000 investment into $100,000 or more.

16. Invest with Peer-to-Peer Lending

You’ve likely heard of Peer to Peer Lending, but you may not be entirely sure how it works. In short, peer-to-peer lending is a way to invest your money and earn a return by lending it to borrowers.

By investing in Peer to Peer Lending, you can potentially earn a much higher return on your investment than you would with traditional investments like FDs or bonds.

And if you’re looking to turn a small investment into a large one, Peer to Peer Lending can be a great option.

You should keep in mind before investing that Peer to Peer Lending is not without risk.

There is always the chance that a borrower will default on their loan, which could lead to losses for investors.

Hence, it’s essential to diversify your investments and don’t put all your eggs in one basket.

Investing in multiple loans can spread out your risk and potentially increase your chances of success.

Stay patient as it can take time for loans to be finalized and funded, so don’t expect to see immediate returns on your investment.

17. Use Automated Investing Platforms like Acorns or Stash

If you’re not interested in actively managing your investments, you may consider using an automated investing platform like Acorns or Stash.

With these platforms, you can set up an account and let the platform manage your investments for you.

You can choose how aggressive or conservative you want your investments to be, and the platform will do the rest.

Automated investing platforms are a great way to invest your money without putting in much effort.

Plus, they can help you turn a small investment into a large one over time through the power of compounding returns.

Related: Best apps to start investing for passive income!

18. Purchase a CD or Government Bond

If you’re looking for a safe and low-risk way to turn $10,000 into $100,000, you may want to consider investing some amount in a CD or government bond.

With these investments, you loan your money to a bank or the government and earn interest on your investment over time.

The returns are typically lower than other investments like stocks or real estate, but the risk is also much lower.

CDs and government bonds are excellent options for people who want to invest their money but don’t want to take on too much risk.

19. Purchase Dividend-Paying Stocks

For earning income from your investments, you may consider investing in dividend-paying stocks.

Dividend stocks are stocks that pay out regular dividends to shareholders.

These dividends can provide income or can be reinvested into the stock to compound over time.

Plus, you’ll also see capital gains if the stock price increases.

Dividend stocks are a great way to earn income from your investments, and they can also help you turn a small investment into a large one over time.

20. Invest in REITs

REITs, or real estate investment trusts, are a great way to invest in real estate without owning any property.

REITs are companies that own and operate income-producing real estate, such as office buildings, shopping centers, apartments, and warehouses.

They are required by law to pay out 90% of their taxable income to shareholders in the form of dividends.

This makes them an excellent investment for people looking for a steady income from their investments.

If the stock price increases, REITs can offer the potential for capital gains.

Investing in REITs is a great way to get exposure to the real estate market without owning any property.

21. Start a Roth IRA

If you’re looking for a way to turn $10,000 into $100,000 over the long term, you may want to consider starting a Roth IRA.

A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement.

This makes it a great way to save for retirement.

Plus, if you invest in stocks or other growth investments, you can potentially make a lot of money over time through the power of compounding returns.

Starting a Roth IRA is a great way to turn $10,000 into $100,000 over the long term.

22. Start An Etsy Store

If you’re creative and have a knack for making things, you may consider starting an Etsy store.

Etsy is an online marketplace where people can sell handmade or vintage items.

If you have a unique product with a small investment, you may make a lot of money by selling it on Etsy.

Plus, starting an Etsy store is a great way to turn your creative hobby into a business.

23. Invest in a Franchise

If you’re looking for a proven business model to help you make a lot of money, you may want to consider investing in a franchise.

With a franchise, you’ll be able to use a proven business model to start and grow your business.

Plus, you’ll have the franchisor’s support, which can help you succeed.

Investing in a franchise is a great way to make money and achieve financial independence.

24. Try Flea Market Flipping

If you’re looking for a way to make some quick cash, you may want to consider flea market flipping.

With this side hustle, you can buy flea markets and garage sales items and then sell them online for a profit.

Flea market flipping can be a great way to make extra money and be fun.

25. Advertise Yourself to Get More Clients

You may consider advertising yourself to get more clients if you’re a freelancer or consultant.

There are several ways to do this, such as creating a website or blog, writing articles, or using social media.

Advertising yourself is a great way to get more clients and make more money.

For example, if you can get just one additional client who pays you $1,000 per month, you’ll be able to make an extra $12,000 annually.

26. Invest in Yourself

If you want to make more money, you must invest in yourself.

This means taking the time to learn new skills, attending seminars and workshops, and reading books.

By investing in yourself, you’ll be able to make more money and achieve your financial goals.

Investing in yourself is one of the best ways to turn $10,000 into $100,000.

What to Do Before Investing

Pay Debts and Build an Emergency Fund

Investing is essential, but it’s not the most important thing.

Before you start investing, you need to make sure that you have a solid financial foundation.

This means paying off your high-interest debt and setting up an emergency fund.

Once you have a solid financial foundation, then you can start investing.

Create a Budget

You also need to make sure that you’re living within your means.

The best way to do this is to create a budget.

When you have a budget, you’ll know how much money you have to work with each month.

This will help you make smart financial decisions and stay on track with your goals.

Build Credit

If you’re going to be investing in real estate, then you need to have good credit.

This will help you get the best terms on loans and make it easier to qualify for financing.

You can build credit by using a credit card responsibly and making all your payments on time.

How to Double 10k Quickly

There are many ways to double your money, but some methods are better than others. You can double your money in mutual funds or bonds, but it will take longer.

But if you want to do it fast, here are a few of the best ways to turn $10,000 into $20,000 quickly:

1. Start a Business

You may want to consider starting your own business if you’re an entrepreneur.

Starting a business can be a great way to make money quickly.

Plus, it’s also a great way to achieve financial independence.

2. Invest in the Crypto Market

If you’re looking for a high-risk, high-reward investment, you may want to consider investing in cryptocurrency.

Cryptocurrencies are a new asset class that has the potential to provide investors with massive returns.

However, it’s important to remember that the cryptocurrency market is highly volatile, so you should only invest money you’re prepared to lose.

3. Start a Blog

If you’re passionate about a particular topic, you may consider starting a blog.

Blogging is a great way to share your passions with the world and can also be a great way to make money.

You can make money through advertising and affiliate marketing if you build a large enough following.

You can invest your 10k in buying ads etc., to get that traffic fast to make more money compared to organic growth.

4. Invest in Real Estate

You may consider investing in real estate if you’re looking for a solid investment that can provide consistent growth.

Real estate is a proven asset class that can help you build wealth over time.

Plus, if you invest in suitable properties, you can also make a lot of money in the short term.

But be cautious because there is always a higher risk whenever you are after higher returns.

Final Thoughts on How to Convert $10k to 100k

There are a lot of ways to turn $10,000 into $100,000.

Your chosen method will depend on your goals, risk tolerance, and time frame.

If you’re looking for a quick return, you may consider starting a business or investing in the cryptocurrency market.

But if you’re looking for a more long-term investment, you may want to consider investing in index funds.

Whatever method you choose, make sure you do your research and understand the risks before investing any money.

And remember, it takes time to build wealth.

So don’t get discouraged if your investment doesn’t grow as quickly as you’d like. Keep working towards your goals; eventually, you’ll reach your financial targets.

FAQs

How can I turn $20,000 into $100,000 in one year?

There are a few ways to turn $20k into $100k in one year. You could start a business, invest in the cryptocurrency market, or start a blog.

But keep in mind that these methods come with higher risks. So make sure you understand the risks before investing any money.

Is it possible to turn $10,000 into $1 million?

Yes, it is possible to turn $10,000 into $1 million. But it will take time, patience, and hard work.

What is the best way to double my money?

There are many ways to double your money, but some methods are better than others. You can double your money in mutual funds or bonds, but it will take longer.

But if you want to do it fast, you can turn $10,000 into $20,000 quickly with Cryptocurrency or Real estate.

What is the best way to invest $10,000?

The best way to invest $10,000 depends on your goals and risk tolerance. If you’re looking for a quick return, you could start a business or invest in the cryptocurrency market.

But if you want a more long-term investment, you may want to consider investing in real estate.

Sumeet is a Certified Financial Education Instructor℠ (CFEI®) and the founder of Dollarsrise. He has been writing about earning extra cash online from his personal experiences for the last four years and his work has been quoted in top finance websites like Yahoo! Finance, GOBankingRates, CNBC, and more. Follow this website to learn easy and real-life hacks to raise your pile of dollars.